What Are the Future Trends of Additive Manufacturing in Europe?

In recent years, the additive manufacturing market has clearly shown its potential as trends begin to emerge. And since a technology like additive manufacturing never stands still, we can also always look forward to new trends, developments and opportunities. This year, as in previous years, CECIMO, the European Association of Machine Tool Industries and Related Manufacturing Technologies, conducted a survey, the European Additive Manufacturing Survey, about the most important trends on AM within Europe. Specifically, it is a six-month survey whose primary purpose is to help industries identify trends for potential major business areas. This will be carried out by assessing companies working within the additive industry. In order to obtain as much data as possible, CECIMO has even entered into cooperation with the VDMA, the German Engineering Federation, which also represents AM companies in Germany.

This report on trends in Europe is divided into two parts: firstly, it shows the results of the data from the CECIMO survey combined with the VDMA survey. For information, the former asks about expectations; the latter, about the actual development of the sector. The second part only shows data from those countries that use the CECIMO survey themselves. Thus, both parts address topics such as trends as a whole, but also show the data collected information such as investments, statistics on materials and machinery, exports or even customers from different industries such as automotive or aerospace.

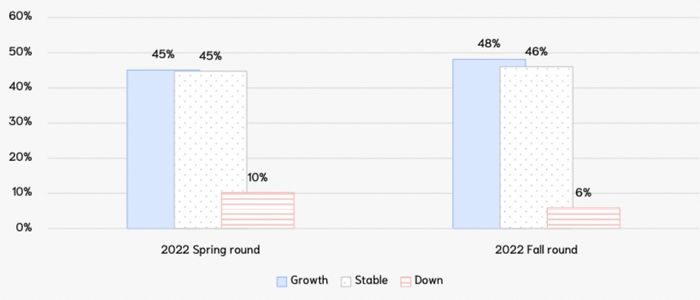

Expectations of growth within the domestic market have increased when compared to the previous survey of spring 2022 (Image: CECIMO)

Exciting Trends are Emerging in Europe in the AM Sector

CECIMO distinguishes between the domestic and the foreign market in terms of trends. If we look at the respective domestic market, according to the survey carried out, it is noticeable that a slight increase in the market growth of the domestic market is expected by around 50% of the respondents, whereas just 6% of respondents expect a decline – this has also decreased compared to the last survey carried out. Therefore, views to the growth of the domestic market have become more optimistic. Similarly, if we look at the foreign market according to the survey, this year’s results show that especially in contrast to the last survey conducted, respondents have a more positive outlook on the growth of the AM market. 47% think that exports and orders originating from abroad will increase within the next six months. 47% think that the number of foreign orders will remain the same and the remaining 6% expect a decrease in the foreign market. In summary, CECIMO states that this is an ever-increasing optimism within additive manufacturing companies and an indication of stronger foreign demand in the European market.

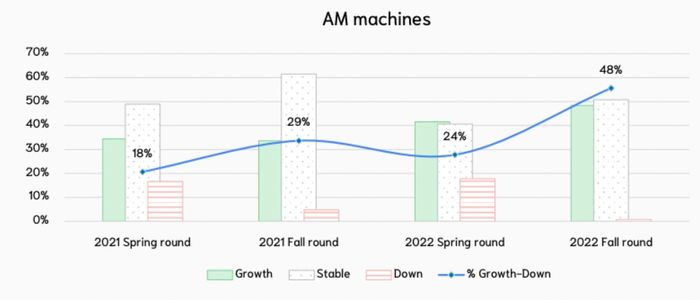

When asked how the respondents assess the order situation in their own market in the next six months – especially in comparison with the previous six months – optimism is evident, indicated by the fact that the percentage expectations in all AM categories (products/manufacturing parts, machines, materials and services) are higher than before. According to the CECIMO survey, the AM products and manufacturing parts category will experience the strongest growth. A full 52% expect growth, with just 1% expecting a decline. This one percent is particularly encouraging because, in the Spring 2022 survey this figure was 16%. The remaining 36% expect the results to remain the same. It may sound unsurprising to some, but the second-best category is that of AM machinery. After a slight decline in the spring of 2022, this has now risen again significantly. It also shows positively that here, too, only 1% of respondents expect a decline in incoming orders. This means that manufacturers of AM machines in particular will benefit.

For the respondents of the survey, the AM machine category is extremely promising (Photo credit: CECIMO)

AM Industry Expects Increase In Investments

If we compare this year’s survey on additive manufacturing trends in Europe, more companies stated that they expect an increase in future investments (36%), but also more companies think that a decrease will happen (9%). However, CECIMO is also optimistic and describes that, especially in view of the strong additive market and its previous growth, this positive investment development will most likely continue. The survey also addresses opinions on future exports. Overall, it can be summarized that more foreign/export orders are expected. This is a similar tendency to the forecasts for the domestic market: the percentage of respondents who are negative about this is lower, while more respondents are forecasting an increase. AM service providers are expected to show the highest growth in orders, with a positive balance of 59%.

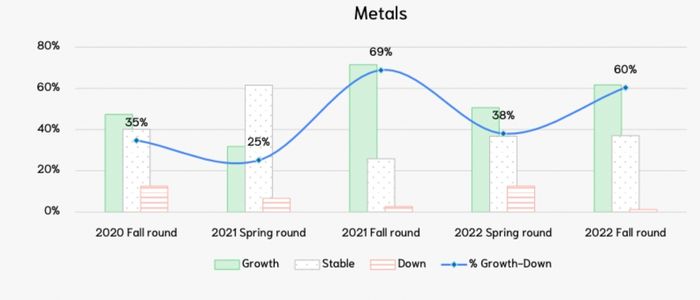

As far as trends in Europe with regard to materials are concerned, respondents were asked to give their opinion on overall order numbers. In direct comparison with the survey conducted in spring 2022, we still see strong growth, but with different trends. The trade with composite materials experiences a slight decline in terms of order predictions, metals are in second place with 60%, whereas only 1% of the respondents expect a negative decline in orders for the next six months. As far as ceramics as a material for AM is concerned, the consensus in terms of trends in Europe is also that there will continue to be an increase here. Specifically, 39% of respondents give this forecast, compared to only 12% in the previous survey.

In the metals as materials sector, just 1% expect a decline (Image: CECIMO)

The order intake by customer segment is also discussed in CECIMO’s report on trends in AM in Europe. In summary, it can be said that the percentage balance in the aerospace, mechanical engineering and chemicals & pharmaceuticals sectors has improved strongly and the respondents expect better business in this area. Particularly strong mention should be made of the aerospace sector, whose positive percentage rose from 7% to 37% and thus represents the highest measured value since the survey began. The respondents are not quite as confident in the automotive sector, whose positive growth balance has been minimized from 41% to 28%. Even though order expectations in this sector are still high, the subjects do not feel nearly as positive about this sector as before. As a reason for this trend in Europe, CECIMO states that there are increasing challenges and problems on the supply side. After the last survey on AM orders from the chemical and pharmaceutical sector, this sector could finally show a positive expectation value again. However, this encouraging result is overshadowed by the fact that this expectation for additive manufacturing orders is still below 2020 and 2021 levels.

In summary, this report and the attitudes of individual respondents to AM trends in Europe can still be seen as positive, especially when looking at direct comparisons to previously conducted surveys. If you want to learn more about AM trends, please click HERE.

What do you think of these trends? Which one would you say is the most important? Let us know in a comment below or on our LinkedIn, Facebook, and Twitter pages! Don’t forget to sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox! You can also find all our videos on our YouTube channel.

*Cover photo credits: CECIMO