New Report Shows Struggling Industrial 3D Printer Sales With Hope for Better 2025

2024 was not the best year for the 3D printing industry. When we looked back at the trends that had marked it, turbulence was dominant throughout, with failed mergers, layoffs, leadership changes and more. This struggle has been further shown in a recent report from CONTEXT, which highlights the difficulties of the entire market, especially industrial 3D printers. Even if there seems to be some hope for improved growth in 2025.

Already last year, industrial 3D printer shipments showed signs of slowing, although desktop 3D printers were on the rise. What does that mean? The London-based market intelligence and analytics company CONTEXT defines these categories by price: personal (or desktop) <$2,500; professional $2,500–$20,000; midrange $20,000–$100,000; industrial $100,000+. It is therefore the most expensive 3D printers have are seeing a major decrease in shipments, while the cheapest seem to be increasing in year-on-year growth.

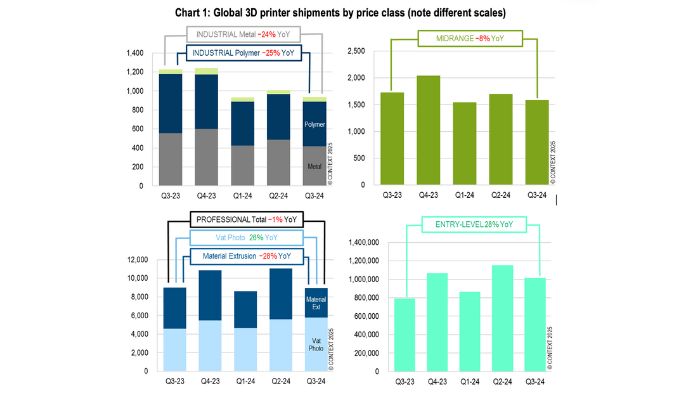

Global 3D printer shipments by price, showing the decrease for all but entry-level solutions (photo credits: CONTEXT)

As can be seen in the graph above, among the different price categories, both polymer and metal industrial 3D printer shipments decreased from the beginning of Q1 2024. Although there was some recovery in Q2, this trend continued in Q3, with an overall decrease of 25% compared to Q3 2023 for polymers and 24% for metals. This was compounded by what CONTEXT notes as a turbulent and chaotic end to the year, with major industrial 3D printer companies among those impacted. Although this was not the main driver of this decrease.

“While this chaos had significant impacts, newly updated analyses show that 2024 as a whole was even more heavily affected by high interest rates and subsequently muted CapEx spending”, explained Chris Connery, VP of global analysis at CONTEXT. “It therefore seems that full-year figures are likely to be close to the lows seen during the height of pandemic lockdowns in 2020 with at least −12% fewer Industrial printers shipped worldwide in 2024 than in 2023.”

Industrial 3D Printer Sector Suffers While Others Recover

What does this mean concretely? Well, the drop in industrial 3D printer shipments seemed to affect almost all printer modalities and material types. Not only that, but this trend was seen globally. Despite the fact that the year prior, the downward trend in industrial 3D printer shipments had been tempered by growth in the Asian and especially Chinese market. In fact, in China the drop in sales was about 37% compared to 25% in North American and 13% in Western Europe.

Looking more specifically at industrial polymer systems, vat polymerization solutions in this price category continue to suffer. Two global leaders, UnionTech and 3D Systems, especially, saw shipments fall sharply. Both cite the dental market and decreased demand as the driver of this. Still, industrial polymer 3D printers also saw a decrease in growth, down 15%, with material extrusion also seeing a 15% decrease in sales. Material jetting systems are down 43%.

Metal meanwhile actually seemed to hold up better according to CONTEXT through the second quarter of 2024. However, in Q3, only binder jetting system sales remained flat. PBF solutions, while accounting for 74% of new industrial metal systems, had a decrease in shipments of 24% while the second-largest category, DED 3D printers, saw a drop of 18%. Surprising perhaps given a continual focus on the benefits of industrial additive manufacturing in many different sectors, with DED printers especially dominating the show floor at Formnext 2024.

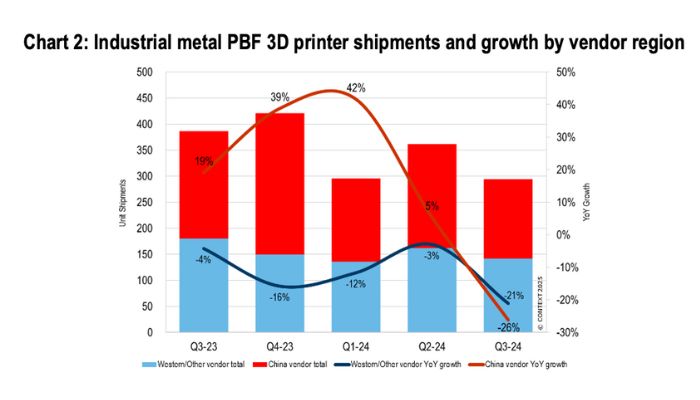

As can be seen in the graph below, regional differences were diminished for metal PBF 3D printer shipments in 2024. Although they had diverged in 2023, with China showing growth while Western companies struggled, by Q2 in 2024, they had come to meet each other. In China, vendors saw a 21% decrease in Q3 while in Europe, there was a 26% decrease.

This chart shows industrial Metal PBF 3D printer shipments, showing the general decrease including in China which had originally seen growth in the beginning of the year (photo credits: CONTEXT)

Meanwhile, stagnation was seen in other price classes as well. Among midrange solutions, there was a decrease of 8% YoY drop in Q3 of 2024. 3D Systems in particular is showing a decreased presence in this category, dropping to sixth place and continuing to struggle. Stratasys however kept hold of its market-share lead despite weak sales in material extrusion 3D printers. Chinese vendors, including UnionTech, ZRapid Tech and Flashforge however fared much better, aggregate shipments were up 46% compared to a decrease in sales of 24% for others.

For professional shipments, sales were overall decreased by 1%, but material extrusion machines saw the worst performance. This is due to an increase in entry-level extrusion solutions and resulted in a decrease of 28% of professional FDM/FFF 3D printer sales. A trend that we had already noted last year and that has been compounded by strong lower-cost offerings from companies like Bambu Lab, helping lead to a growth in entry-level printer shipments of 28%.

Hope for 2025?

So what can we take from this? Well, looking back, 2024 was certainly bleak for 3D printing. But there were signs of hope. In a press release, CONTEXT mentions that even in the struggling industrial sector, vendors like Eplus3D and Nikon Solutions both saw success. Their advanced, multi-laser, high-build-volume metal powder fusion machines helped to push growth.

Indeed, Eplus3D was the global leader in units shipped in Q3 2024, with a growing of 41% as compared to the previous year. TRUMPF and Renishaw also saw YOY shipment increases. Similarly, EOS, Nikon SLM Solutions and Renishaw, among others, saw an increase in revenue.

This has also been seen for other 3D printer categories apart from industrial. For example, although last year CONTEXT found low sales of vat photopolymerization solutions, these grew in the professional price class in 2024. Formlabs dominated the market, driving most of the bounce-back in this category. This is thanks to the release of Formlabs’ new LFD vat photopolymerization 3D printer, which resulted in an overall increase of 26% in sales as compared to the same period in 2023.

Lowered interests rates that in turn will help CapEx spending are expected to herald a brighter 2025 for additive manufacturing. CONTEXT is predicting full-year growth of 14% in industrial 3D printer system shipments. Similarly, midrange printer shipments are forecast to rise 12% and professional systems 6% in 2025. 2026 is expected to have even more consistent and stronger double-digital YoY growth in all sectors, with growth rates of upwards of 30-40% over a 5-year period.

Connery concludes, “To put this in context, note that the market bounced back strongly coming out of COVID [sic] as vendors delivered against pent-up demand: between 2020 and 2021, Industrial 3D printer shipments were up 30% and those of Midrange systems increased by 26%. However, the impact of a change in US government is yet to be determined: while the new administration is generally focused on accelerating business potential, sticky inflation and unknown import restrictions are tempering optimism.” You can find out more HERE.

What do you think of the continued decrease in industrial 3D printer shipments? Do you think we will see improvement in 2025 for the AM industry in general? Let us know in a comment below or on our LinkedIn, Facebook, and Twitter pages! Don’t forget to sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox! You can also find all our videos on our YouTube channel.

*Cover Photo Credits: René Volfík – Institute of Physics of the Czech Academy of Sciences, CC BY-SA 4.0