Industrial 3D Printer Shipments Suffer While Desktop Continues to Soar

It is no secret that financial markets the world over had a challenging year last year. Inflation and high interest rates have sparked fears for a recession, as even the International Monetary Fund noted that policies must be implemented to prevent a crash. This is equally the case for 3D printing, though it seems it has hit certain parts of the market harder than others. Indeed, a new report from CONTEXT has shown that industrial 3D printer shipments have significantly slowed, however entry-level printer sales continue to boom, showing potentially where we could continue to see growth in 2024.

2023 was undoubtedly a challenging year in the additive manufacturing world. A slew of failed mergers, mediocre earnings and stock market woes caused concern, though many of these have been seemingly overstated, with many expecting the market to bounce back this year. That being said, this report has shown that, especially in the realm of industrial 3D printers, there is some at least some basis for concern as it may be time to adapt to the market’s needs.

A Decline in Industrial 3D Printer Shipments

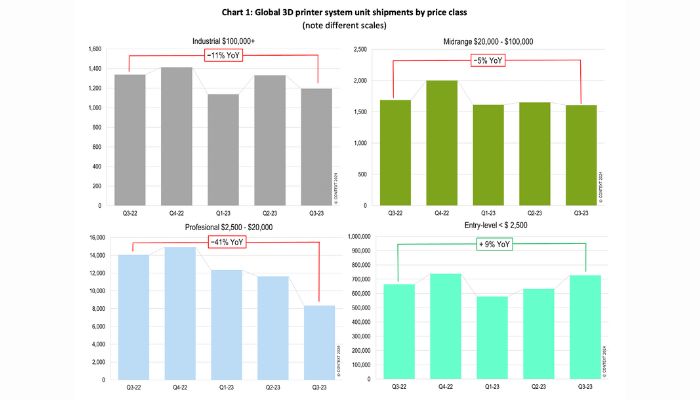

First, it’s important to note the different categories of printers included in this latest report and how they are classified. CONTEXT identifies four separate groups: industrial ($100K+ 3D printers), midrange ($20,000–100,000), professional ($2,500–20,000) and entry-level (3D printers under $2,500). In the report, these were then tracked by sales in order to determine year on year (YoY) growth.

What they found does seem to go against much of the logic currently dominating in additive manufacturing. Despite the fact that more and more manufacturers are creating towards higher-priced professional solutions with more interesting features, interest from consumers seems more geared towards entry-level models. Indeed, the entry-level printer market seems to be the only one who grew in Q3 2023.

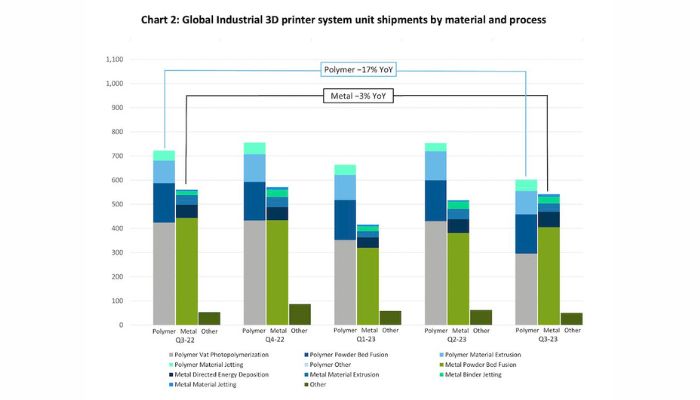

For industrial 3D printer shipments, the polymer segment was hit harder than metal (image credits: CONTEXT)

More concretely, the report found that for industrial systems, global shipments dropped -11% in Q3, with the difference especially stark for polymer solutions: polymer printer shipments dropped -17% while metal 3D printer shipments only went down -3%. Though they do note that the low numbers for polymers seemed to be related to the particularly weak performance of vat photopolymerization printers, which are the largest category of industrial polymer 3D printers.

At the same time, in the metal sector, powder bed fusion shortfalls dragged down the category while larger build-volume, multi-laser powder bed fusion systems and other technologies boosted revenues. This was also helped by increased numbers of Chinese companies moving into the sector, with promising results. DED printers as well saw significant growth, companies like Meltio in particular were seen to be leading the charge.

Midrange printer shipments also fell -5%, though were helped by strong shipments of low-end PBF systems, like the Fuse 1 from Formlabs, and domestic shipments in China, especially from UnionTech. Without UnionTech in particular, 3D printer shipments would have been down -17% according to CONTEXT, with market leaders Stratasys, 3D Systems and Markforged performing particularly poorly. Although this was still nothing compared to printers in the professional price class. This is where we saw the biggest downward trend as 3D printer sales dropped -40%, likely as a result of users turning towards cheaper solutions even if they were lower-performing.

Data from CONTEXT shows that all sales in 3D printer categories, including industrial, except entry-level declined from previous years (image credits: CONTEXT)

What Does This Mean?

While this may look bleak, what is positive however is that entry-level systems have seen significant growth: a 9% increase in shipments in Q3. Though this comes at a cost, namely from cannibalization of sales from professional 3D printers, it shows that the market is still strong. This has been emphasized especially by the growth of companies like Bambu Lab and Elegoo while Creality continues to dominate that segment of the market.

Still, perhaps, this does suggest that a change in strategy is needed for the AM market as users seem happier to stick with cheaper more basic machines rather than more expensive models with all the bells and whistles. Regardless, it will be interesting to see as the year goes on what major 3D printing companies will choose to do. Perhaps the often-overlooked entry-level category will see a resurgence from more established 3D printer manufacturers. And additive manufacturing clearly still has value for many industries. You can learn more HERE.

What do you think of the decline in industrial 3D printer shipments while desktop 3D printers seem to be on the rise? Do you think this is a trend that will continue over the course of 2024? Let us know in a comment below or on our LinkedIn, Facebook, and Twitter pages! Don’t forget to sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox! You can also find all our videos on our YouTube channel.