Revenues Soar as Shipments Dip In Global 3D Printer Landscape

According to a study by CONTEXT, revolutionary shifts and fierce competition have set the stage for the global 3D printer industry as it experienced a mixed bag of results in their latest quarter analysis. While the allure of billion-dollar mergers captured the headlines, the sector faced a complex landscape of inflation, shifting demands, and fluctuating unit sales. From the rise of high-end metal systems to the resilience of polymer machines, the industry’s path forward seemingly is marked by uncertainty and untapped potential.

While in the study it was highlighted industrial 3D printer revenues benefited from inflation and demand for high-end systems, unit sales experienced a decline worldwide. According to market intelligence firm CONTEXT, various companies vied to create the first $1 billion+ 3D printing company during this period. Stratasys, 3D Systems, and Desktop Metal made headlines, with the competition to merge or be acquired by Stratasys taking center stage.

What Are the Trends Globally in 3D Printing?

In terms of global shipments, there were contrasting trends observed among different categories of 3D printers in the first quarter of 2023. While Industrial and Professional printer categories faced a year-on-year decline of 15% and 30% respectively, the Midrange, Personal, and Kit&Hobby categories showed growth with shipment increases of 18%, 34%, and 29% respectively. Despite these variations, the overall system revenues exhibited a positive growth of 15% compared to the previous year.

The decline in global shipments of Industrial systems, which account for the majority of total system revenues, was primarily driven by weaker sales of polymer systems. Though, there was a notable 11% year-on-year increase in system revenues, mainly due to the growing demand for more efficient metal machines. Within the Industrial polymer printer segment, the most significant decline was observed in vat photopolymerization machines. For example, North America experienced a slump in sales to certain dental markets as consumers adjusted their spending priorities amid inflation. Similarly, China reported weak sales of higher-end vat photopolymer systems across various industrial sectors.

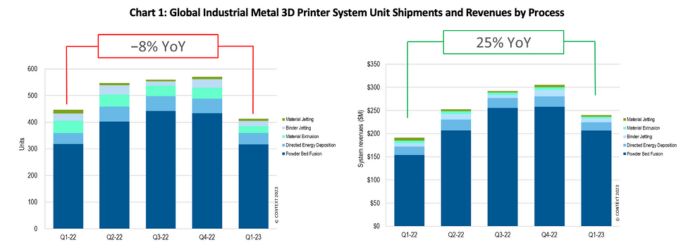

Conversely, revenues from Industrial metal 3D printers experienced a noteworthy 25% year-on-year increase in Q1 2023, despite an 8% decline in unit sales. The majority of metal system shipments were attributed to powder bed fusion (PBF) printers. Although the number of sales presented challenges, the demand for more productive and larger systems contributed to a significant revenue growth of 34% for Industrial PBF systems. In the Midrange category, which is dominated by polymer machines, there was an 18% year-on-year growth in unit shipments. This growth can be attributed to successful new product launches and strong domestic demand, particularly in China. Notably, Formlabs achieved remarkable success by tapping into new demand and significantly increasing polymer PBF machine shipments within this category.

Professional 3D printer shipments faced a significant drop of 30% year-on-year, but revenues remained relatively stable, falling by only 15%. UltiMaker, in combination with MakerBot, remained the leader in both unit shipments and system revenues. However, vendors like Formlabs initially introduced new products in this category with some success, but seems to be demand shifting to slightly more advanced products, contributing to the overall decline.

In the meantime, Personal and Kit&Hobby categories saw excellent sales of lower-end consumer-centric printers, driven mainly by improved supply-chain logistics. Bambu Lab stood out in this category, successfully transitioning from crowdfunding to mainstream commercialization.

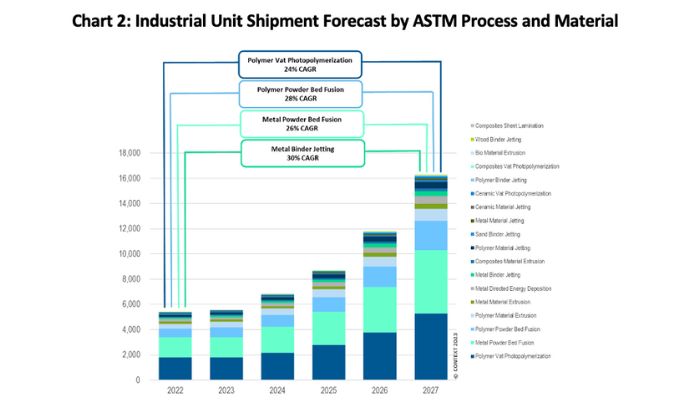

Looking forward, while industry consolidation has garnered attention, the growth prospects for 3D printing remain positive. The demand for 3D printing is growing, especially in prototyping, mass customization, and low-volume production of complex parts. The volume mass production sector holds significant growth potential in the coming years, particularly for technologies like vat photopolymerization and PBF for polymers, and PBF and binder jetting for metal AM. Despite fluctuations in unit sales, the 3D printer industry continues to evolve, with advancements in technology and the potential for expansion into mainstream production. To learn more, visit the original source HERE.

What do you think of the global 3d printer industry? Let us know in a comment below or on our LinkedIn, Facebook, and Twitter pages! Don’t forget to sign up for our free weekly Newsletter here, the latest 3D printing news straight to your inbox! You can also find all our videos on our YouTube channel.

*All Photo Credits: CONTEXT