CONTEXT reveals its predictions for polymer and metal 3D printer trends

CONTEXT, the London-based research firm revealed that we could expect good growth in shipments of both metal and polymer industrial and design 3D printers in 2019. The company defined industrial as 3D printers over $100K and design between $20K and $100K. In fact, the cheapest class of 3D printers (under $2.5K) had already suffered in 2018 according to their report and this trend should continue. On the other hand, the industrial category, which accounts for 70% of the global revenues of printer hardware, experienced a year-on-year growth rate of 18%.

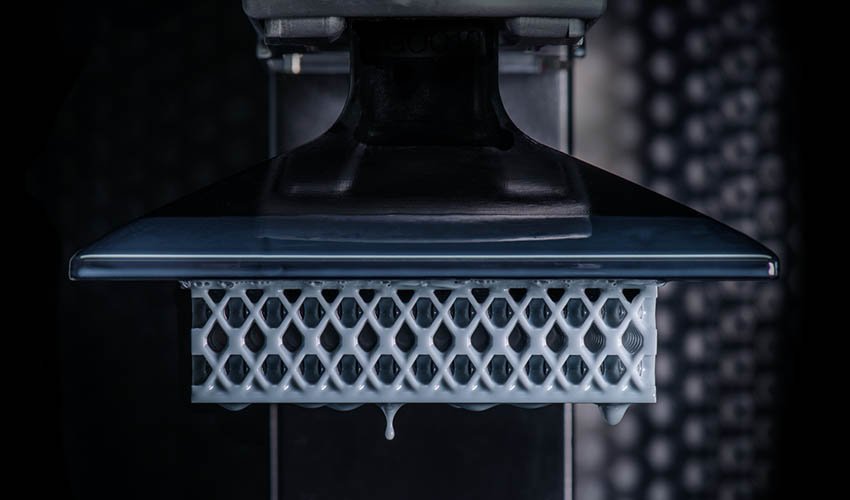

Growth in 2018 can therefore be boiled down to the increases in shipments of both metal 3D printers – up 26% year-on-year – and industrial and design class polymer 3D printers such as Carbon’s, HP’s and 3D Systems’. As for the professional segment, defined in the report as 3D printers between $2.5K and $20K, also saw good growth in 2018.

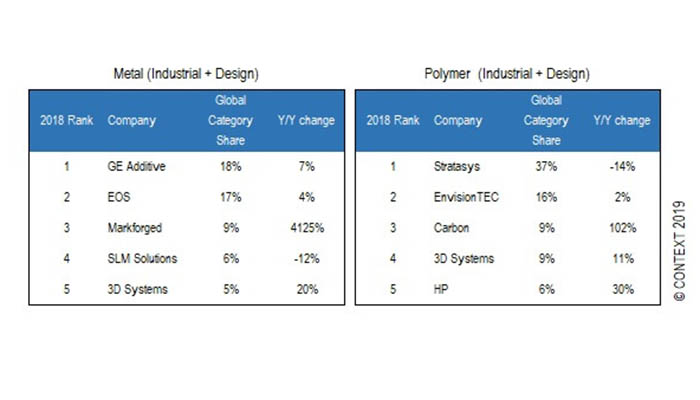

Top 5 industrial & design 3D printer vendor shipment share by machines shipped in 2018 | Credits: CONTEXT

In terms of innovations, the market saw the emergence of lower-priced multi-step metal printers, from Markforged and Desktop Metal for example. Chris Connery, VP of Global Research at CONTEXT comments, “New, lower priced metal 3D printers are targeted not just for factory use but also for office use and do not necessarily compete head-to-head with the more traditional robust metal 3D printers which use lasers to fuse powder in a single-step such as those from GE Additive, EOS, SLM Solutions, 3D Systems and others. Powder bed laser-based 3D printers are currently used for everything from jet engine parts to orthopaedic implants. New lower-priced metal printers look to augment this usage to now allow for more economical ways to create metal prototypes for these parts as well as allow for cheaper low-volume production of metal parts.”

Carbon’s 3D Printers

Economical low-volume production and prototyping have been important segments for polymer 3D printing technologies, but is rather new for the metals market. Within the polymer technologies, the year 2018 was filled by important events that promise to accelerate the use of 3D printing in mass-customisation production as well as in low-volume serial production. Examples included Carbon’s partnership with Adidas or Riddell and HP pushing into its supply chain by using its own technology to print parts.

The combination of these factors means that 2019 is expected to see the shipment of 25% more machines in the combined industrial and design segments than shipped globally in these same categories in 2018. Metal printer shipments are projected to see year-on-year unit-volume growth rates of over 49% with polymer machine shipments expected to grow by over 20%.

What do you think of these predictions? Let us know in a comment on our Facebook and Twitter pages! Don’t forget to sign up for our free weekly Newsletter, with all the latest news in 3D printing delivered straight to your inbox!

Great article and gives a clear view of the challenges facing the 3D printing industry. Very useful for anyone interested in this technology!

Is the durability of cheap metal machines lower than expensive ones?