What Were the Key 3D Printing Trends in 2025?

As the end of the year approaches, we at 3Dnatives are taking a step back to analyze what has truly defined the additive manufacturing industry in 2025. It is already clear that this has been a year of technological maturity, shaped by a broader reconfiguration of the market. Shifts in market dynamics, the consolidation of several applications, and a clear move toward real-world adoption all stood out. In this article, we review the key trends that marked 2025 and place them in context to better understand how the industry has evolved over the past year and where it is headed next.

Last year, we described a “gloomy” period for the additive manufacturing market, driven largely by heightened activity among key industry players. This included, for example, the disputes between Stratasys and Bambu Lab, as well as Nano Dimension’s acquisitions of Markforged and Desktop Metal. That context, however, set the stage for what unfolded in 2025: a year in which the market began to stabilize, certain applications proved their real-world viability, and not all players succeeded in adapting to the new landscape.

The Bambu Lab booth at Formnext 2025. The company continues to grow in the desktop 3D printing sector. (Photo Credit: 3Dnatives)

At the same time, trends that were already emerging last year gained real momentum. China further strengthened its position as a central player in the market, while major manufacturers such as Stratasys, HP, and Raise3D expanded their portfolios to include new materials. Strategic sectors like defense and aerospace also confirmed that additive manufacturing has definitively moved beyond its experimental phase. Against this backdrop, the question is no longer whether the industry remains in a “gloomy” period, but what kind of industry is emerging after this phase of adjustment. Read on to find out!

Natural Selection in the Additive Manufacturing Market

What would the additive manufacturing industry be without its ups and downs? 2025 was, without question, a year of significant corporate reconfiguration, and few cases illustrate this better than Nano Dimension, Desktop Metal, and Markforged. After announcing its intention in 2024 to acquire Desktop Metal and Markforged, Nano Dimension finalized both deals in 2025, though not without controversy.

In the case of Desktop Metal, the process was shaped by a legal dispute. The company filed a lawsuit alleging that Nano Dimension had failed to meet its regulatory obligations in a timely manner, particularly with regard to approval from CFIUS. This unfolded amid internal instability following the dismissal of then-CEO Yoav Stern. The legal proceedings extended into early 2025, with expedited hearings and a trial scheduled for March, before the acquisition was ultimately finalized on April 2, 2025.

At the same time, Nano Dimension went through a period of leadership instability. At the end of 2024, the company dismissed Yoav Stern after five years at the helm. Julien Lederman stepped in as interim CEO, followed in April 2025 by the appointment of Ofir Baharav as chief executive, tasked with accelerating the integration of Desktop Metal and Markforged. This phase proved short-lived: Baharav stepped down in September 2025, and a few months later Nano Dimension named David Stelhin as its new CEO.

Meanwhile, Desktop Metal reached its most critical point in March 2025, when it filed for Chapter 11 bankruptcy protection to restructure its debt. As part of this process, the company began divesting several of its key international subsidiaries, including ExOne and EnvisionTEC, in an effort to stabilize operations and preserve core technological capabilities.

In 2025, Nano Dimension completed the acquisition of Desktop Metal and Markforged. (Photo Credit: Nano Dimension)

The impact of these decisions was evident in Nano Dimension’s financial results at the end of 2025. The company closed the third quarter with revenues of $26.9 million, up from $14.9 million in the same period the previous year. A significant portion of this growth, $17.5 million, was directly attributable to the acquisition of Markforged, while Desktop Metal was reclassified as a discontinued operation following its bankruptcy and subsequent deconsolidation. These moves clearly came at a high cost. At the same time, they underscore that the additive manufacturing industry remains in a phase of reorganization, or “natural selection,” in which not all players are able to adapt at the same pace.

Another notable adjustment in 2025 involved BCN3D Technologies. The Spanish manufacturer of industrial FFF printers went through several months of uncertainty after entering insolvency proceedings, following unsuccessful efforts to restructure its debt despite strong technological credentials and multiple public and private investments. The process ultimately resulted in the acquisition of its assets and operations by Quantum, a newly formed investment group that ensured continuity for both the business and its team. This new phase aims to establish a leaner organizational structure, focused on consolidating BCN3D’s position in light industrial applications.

Finally, another high-profile development in 2025 was Arburg’s withdrawal from the additive manufacturing market. The German manufacturer, best known for its Freeformer pellet-based systems, cited a challenging economic environment and the need to refocus on its core business of injection molding. The company’s exit from additive manufacturing will take effect on December 31. However, Arburg will continue to provide technical support, spare parts, and ongoing service for existing users.

In 2025, German company Arburg withdrew from the additive manufacturing market. (Photo Credit: Arburg)

The events of 2025 suggest that additive manufacturing is undergoing a phase of structural adjustment rather than expansion. At the same time, the year can be seen as a period of selection, in which the market begins to define which players will lead the next phase of additive manufacturing.

The Diversification of Major Manufacturers

Another clear trend in 2025 was the strategic shift undertaken by several established manufacturers. Stratasys, HP, and Raise3D all began expanding their portfolios toward new technologies. Stratasys made a particularly strategic move by formally entering the metals and ceramics space through a partnership with Tritone Technologies, the developer of MoldJet technology. This process enables the production of high-density metal and ceramic parts using plastic-printed molds, combining Stratasys’ expertise in polymer additive manufacturing with Tritone’s industrial production capabilities.

With this move, Stratasys aims to address growing customer demand, particularly from sectors such as defense, aerospace, and government, which require solutions capable of integrating polymers and metals within a single manufacturing ecosystem. HP, meanwhile, drew attention at Formnext with the launch of its first industrial filament 3D printing platform, the HP IF 600HT, designed for high-temperature materials and high-performance environments such as aerospace and defense. This move signals HP’s intention to expand its portfolio beyond Multi Jet Fusion, targeting demanding applications that require complex and durable parts.

On the left, the new SLS printer from Raise3D. (Photo Credit: Raise3D) On the right, the new filament solution from HP. (Photo Credit: HP AM Solutions)

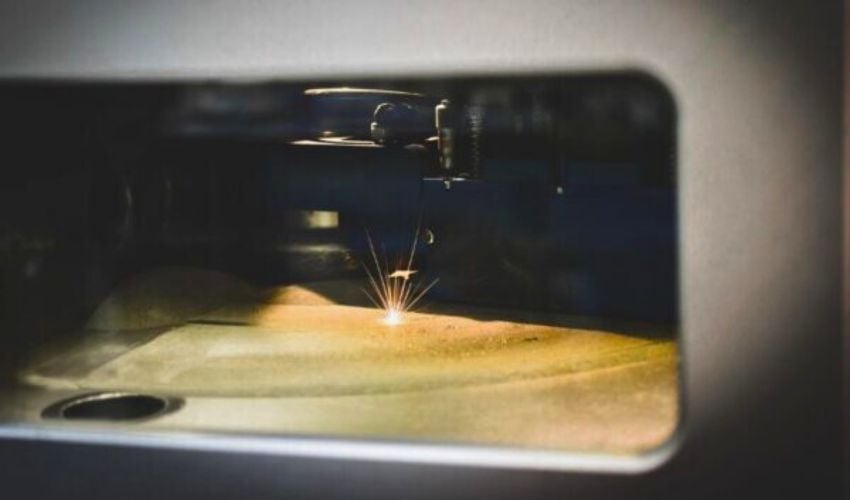

In line with this broader diversification trend, Raise3D also took a significant strategic step in 2025 with the launch of its first SLS printer, the RMS220. Known for its professional FDM systems and, more recently, its resin platforms, the company announced its entry into selective laser sintering at the TCT Asia trade show. With this launch, Raise3D aims to position itself as a multi-technology player in the professional segment, offering solutions across filament, resin, and SLS. Taken together, these strategic shifts clearly illustrate how major manufacturers are moving toward more comprehensive offerings designed to address a wide range of additive manufacturing needs across the industry.

The Rise of the Chinese Market

The label “Made in China” no longer has the same meaning it did twenty years ago, and the additive manufacturing industry is clear proof of this. China has established itself as one of the sector’s leading players, driven by strong technological capabilities and a carefully executed global ambition.

This consolidation was clearly reflected at Formnext. Asian manufacturers once again dominated the show, significantly outnumbering their US counterparts, despite the United States being the historical birthplace of additive manufacturing. At the previous edition, Formnext featured 53 US exhibitors compared to 101 Chinese companies. In 2025, although the fair slightly reduced its overall exhibitor count, the trend persisted, with 54 US exhibitors versus 95 Chinese ones. In short, there were fewer exhibitors overall, but a proportionally even stronger Asian presence.

Within this broader context, Bambu Lab has emerged as one of the most influential names in the industry, becoming something of a celebrity in the world of 3D printing. While its rapid growth had been widely anticipated, 2025 marked a particularly important year for the Chinese manufacturer with the launch of what are, to date, its most advanced desktop 3D printers: the H2D and the H2S. This success is far from accidental. Bambu Lab has effectively combined technical innovation, ease of use, and a highly competitive value proposition, helping make 3D printing genuinely accessible to a broad audience.

Bambu Lab stole the show at Formnext 2025 with the presentation of its latest solutions. (Photo Credit: 3Dnatives)

Bambu Lab has not only become one of the most popular brands within the maker community, but has also successfully expanded into industrial and educational environments, while reaching new audiences such as children and young people discovering the technology through its machines. This has been accompanied by a commercial strategy rarely seen in the 3D printing market, notably the opening of a physical retail store in China to increase brand visibility and strengthen its connection with users.

In 2025, Bambu Lab’s influence has continued to grow. Its trajectory reflects a broader demand for solutions that are reliable, intuitive, and offer strong value for money. This trend remains a key driver of the market and is pushing other manufacturers to rethink their positioning and strategies.

The growth of Asian manufacturers is no longer confined to the desktop market. Several companies from the region have strengthened their presence in the industrial segment, beginning to compete in technologies that until recently were dominated by a small group of Western players. A clear example is electron beam melting (EBM), a process long associated with Arcam, which is now seeing new entrants from Asia. Companies such as QBeam, Xi’an Sailong Metal, and JEOL, drawing on their experience with other electron beam systems, are increasingly moving into this space.

At the same time, established players such as Farsoon, E-Plus-3D, and BLT continue to strengthen their capabilities in other metal additive manufacturing technologies. By expanding their solution portfolios, improving system reliability, and gaining traction in demanding industrial sectors, these companies are further reinforcing Asia’s growing role in the industrial AM landscape.

Technological Maturity in Critical Sectors

In 2025, the defense and aerospace sectors have clearly demonstrated how additive manufacturing is moving beyond the prototyping phase to establish itself in real-world, highly demanding applications. This shift was also evident on the exhibition floors of Formnext this year.

Within the defense sector, the current geopolitical climate has played a decisive role. Ongoing conflicts and rising international tensions have prompted many countries to strengthen their military capabilities and prepare for potential conflict scenarios. In this context, additive manufacturing has emerged as a strategic tool. Over the course of the year, there has been a noticeable increase in the acquisition of industrial 3D printers by government agencies, particularly in the United States, alongside growing collaboration with 3D printing service providers for military applications.

The defense sector has seen the most growth in additive manufacturing during 2025.

This strategic shift became even clearer with the recent approval of the National Defense Authorization Act (NDAA) in the United States. The legislation marks a turning point for advanced manufacturing, as for the first time additive manufacturing has been formally recognized as critical infrastructure within the United States Department of Defense, making it subject to clearly defined standards for security, traceability, certification, and scalability. The implications of this decision are far-reaching, as they directly affect how parts are designed, validated, produced, and maintained across areas such as defense, aeronautics, naval operations, and ground-based systems.

One of the most significant aspects of this legislation is the redefinition of trust requirements in defense. The National Defense Authorization Act prohibits the United States Department of Defense from using additive manufacturing systems that are manufactured, developed, or connected to entities in countries such as China, Russia, Iran, or North Korea. This measure reinforces the strategic role of 3D printing in defense and is likely to have a direct impact on technology choices and overall market dynamics.

This new framework confirms that additive manufacturing is now firmly embedded within the defense industrial ecosystem and is no longer viewed merely as a tool for experimentation.

Turning to the aerospace sector, the maturity of 3D printing has been particularly evident in the production of engines and other critical components. Throughout 2025, multiple companies carried out testing and validation of rocket engines incorporating 3D-printed parts into operational systems. Examples from New Frontier Aerospace, POLARIS Spaceplanes, AVIO SpA, and Agnikul Cosmos demonstrate that additive manufacturing is now fully integrated into aerospace programs. These advances have been enabled by the continued evolution of metal additive manufacturing solutions capable of producing parts that withstand high temperatures and extreme mechanical stresses.

The vision of 3D printing in zero gravity remains very much alive. Following the first metal 3D printing operation carried out in space by the European Space Agency at the end of 2024, multiple additional tests were conducted throughout 2025 to determine which materials and processes can function effectively under microgravity conditions. This is a trend that is expected to continue into 2026, according to project announcements such as that of Auburn University in the United States, which plans to 3D print semiconductors in zero gravity next year.

Testing of 3D-printed rocket engines has increased significantly.

Contrasts Across Sectors

Last year, in 2024, we highlighted all the news surrounding 3D food printing. Time and again, new projects, startups, and research initiatives emerged with the goal of bringing this technology into the kitchen. In 2025, however, this application appears to have slowed. While development has not stopped altogether, with ongoing research projects such as those focused on nutrition for people with dysphagia, food 3D printing no longer seems to be progressing at the same pace as in previous years.

By contrast, construction continues to stand out as a growing and increasingly mature application. In 2025, the sector saw a strong push toward more sustainable materials, including recycled mixes and formulations with a lower environmental impact, reflecting the broader global shift toward a circular economy.

One construction player that drew particular attention this year was Caracol. The Italian company, which specializes in large-scale robotic additive manufacturing, raised $40 million. With this funding, Caracol aims to accelerate its international expansion, notably across the United States, the European Union, and the Middle East.

(Photo Credit: Caracol)

As the year comes to a close, 2025 can be described as a period of maturity and adjustment for additive manufacturing. Over the past twelve months, the industry consolidated real-world applications, diversified its material offerings, and underwent a reconfiguration of key players, highlighting how 3D printing continues to evolve toward more comprehensive solutions tailored to industrial needs. We will continue to follow these developments closely and report on the key trends and innovations shaping 2026.

What are your thoughts on the key trends that shaped the additive manufacturing industry in 2025? What changes do you expect to see in 2026? Let us know in a comment below or on our LinkedIn or Facebook pages! Plus, don’t forget to sign up for our free weekly Newsletter to get the latest 3D printing news straight to your inbox. You can also find all our videos on our YouTube channel.